Investing-Strategy

The kenaf industry in the US is new. Other countries have an established kenaf industry that continues to grow. In order to get things off the ground here in the US, investing in processing centers as an investor is predicted to be a worthwhile undertaking. See the prediction below.

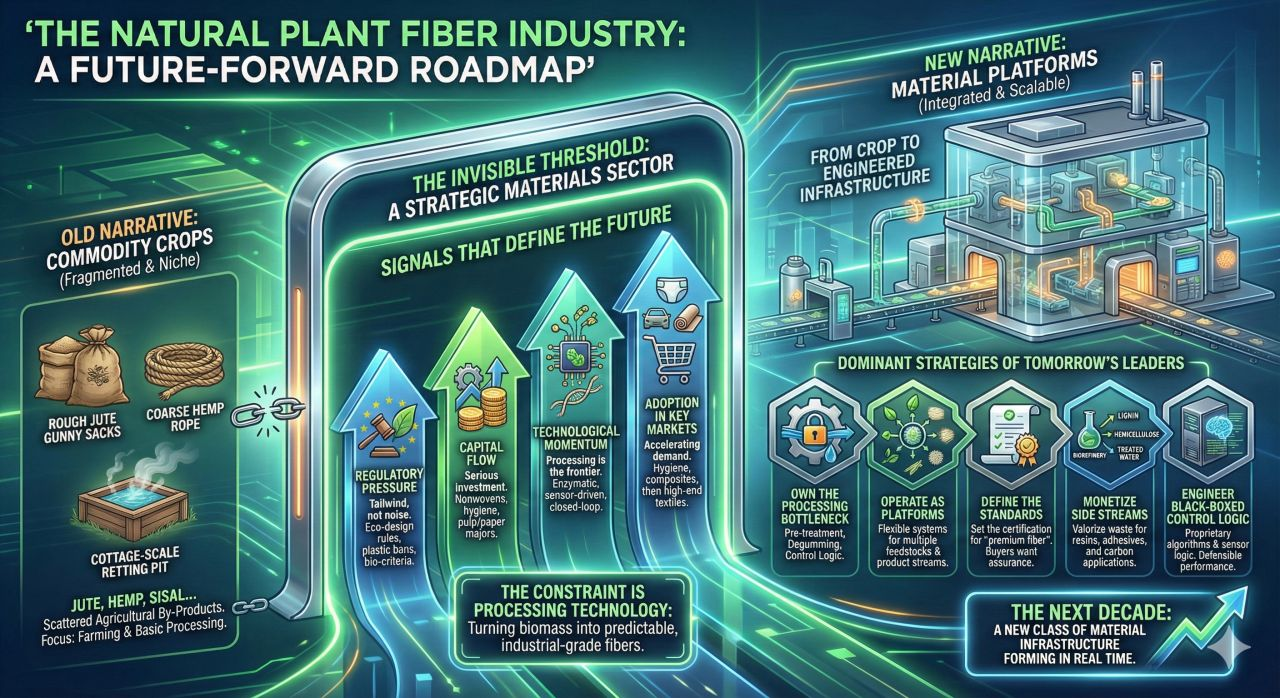

above diagram is credited to

Nazaruddin Mohd Nawi

Critical Path

Our 3-phase approach embraces Establishment, Production, Expansion in that order. A general overview of the Valuable Final Products of each are as follows:

Establishment

- Funding of Phase 1.

- Purchase and deliver kenaf seeds. Seed fresh and at the gleaners in the US. In place pending funding.

- Hire 3 Senior Executives to learn the ins and outs of the kenaf industry in the US as we create it. Identify and determine who is in progress. Hiring pending funding.

- Grower and processor integration and site completed. Renderings, site identified and partners are already in place who have years of experience with putting the building in place, getting the processing equipment in, hiring and running the processing crew and growing and harvesting. In place pending funding. Completion 6 months for building and processing equipment after funding. Hiring crew and training afterwards.

- Set the strategy for all phases of Public Relations and publications etc. In place pending funding. Phase 1 target for each of the 4 textile manufacturers in the state, opening the door to contract signing for the purchase of fiber and/or hurd. Samples available of the specified materials by the manufacturer.

- During this phase a professional filming crew to capture the know-how for educational subscriptions to be rolled out in Phase 2 along with targeted Marketing for seed, fiber, hurd, video subscriptions, and more.

Production

- Our processing equipment and supplier have been chosen to provide the processed material in the most sought-after forms in the various textile, insulation, and building material industries. In place pending funding of Phase 1 and each target completion.

- Phase 1 growing will supply an estimated 1,800 tons of fiber/hurd and 100 tons of seed on the conservative side. Sales and delivery begin in Phase 2.

- With Public Relations and Marketing rolling out and the response will determine the starting parameters for phase 3 Expansion. Our initial phases also incorporate processing equipment delivery time table to coincide with new growing and processing centers in increments of 10 or more.

- Fine tuning all aspects of operations and updating the know-how as we go improving from lessons learned will be the modus operandi.

- Personnel requirements will be a part of this, to keep up with the demand and delivery.

Expansion

Improvement of seed varieties in quantity and quality for additional markets and add-ons to processing equipment to ensure we continue to meet the needs of our customers in each of their zones of operations. A major part of this is the seed supply and delivery in the US.